Mortgage Related News

-

Don’t Close Your Old Credit Cards Yet!

Don’t Close Your Old Credit Cards Yet! Here’s Why It Matters for Your Mortgage Approval If you have an old credit card sitting in your wallet that you rarely use, you might be tempted to close it. After all, why keep something you don’t need? But before you cancel that card — stop! Closing old

-

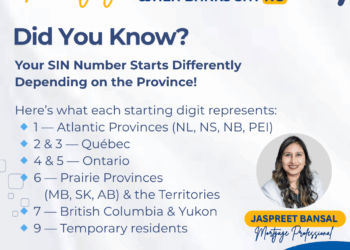

What the First Digit of Your SIN Number Really Means in Canada

What the First Digit of Your SIN Number Really Means in Canada When you receive your Social Insurance Number (SIN) in Canada, it may look like a random set of nine digits — but it’s not!Your SIN actually contains useful information, and one of the most interesting details is this: 👉 The first digit of

-

𝑩𝒂𝒏𝒌 𝒐𝒇 𝑪𝒂𝒏𝒂𝒅𝒂 𝑹𝒂𝒕𝒆 𝑪𝒖𝒕 𝑨𝒍𝒆𝒓𝒕!

🔔🏦 𝑩𝒂𝒏𝒌 𝒐𝒇 𝑪𝒂𝒏𝒂𝒅𝒂 𝑹𝒂𝒕𝒆 𝑪𝒖𝒕 𝑨𝒍𝒆𝒓𝒕!🔔 The Bank of Canada has just reduced its policy rate by 0.25%, which means the prime rate will drop from 4.70% to 4.45%. This is good news for variable-rate mortgage holders and those with home equity lines of credit (HELOCs) — you may see a small drop in

-

Top 5 Mistakes First-Time Home Buyers Make

Top 5 Mistakes First-Time Home Buyers Make (and How to Avoid Them!) Buying your first home is one of the most exciting milestones in life — but it can also feel overwhelming if you don’t know where to start. As a mortgage professional, I’ve seen many first-time buyers make a few common mistakes that can

-

Bank of Canada Cuts Policy Rate by 0.25%

Bank of Canada Cuts Policy Rate by 0.25% – What It Means for You Good news for Canadian borrowers! 🎉 After three consecutive meetings with no change, the Bank of Canada has announced a 0.25% decrease to its policy rate, bringing the prime rate down to 4.70%. This is welcome relief for many Canadians who

-

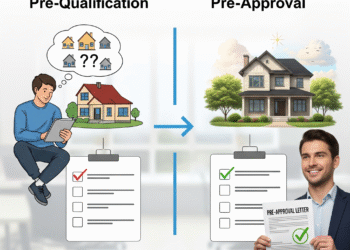

Pre-Qualification vs Pre-Approval: What Homebuyers Need to Know

Pre-Qualification vs Pre-Approval: What Homebuyers Need to Know When it comes to buying a home, many people hear the terms pre-qualification and pre-approval and assume they mean the same thing. While they sound alike, the difference between the two is significant—and understanding it can make or break your homebuying journey. What is Pre-Qualification? Pre-qualification is

-

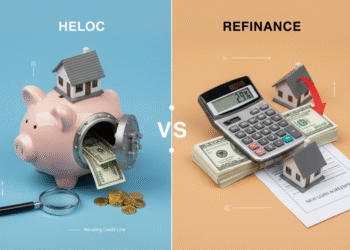

HELOC vs Refinance – Which One is Right for You?

HELOC vs Refinance – Which One is Right for You? Homeowners often reach a point where they want to tap into their home equity. The big question is: should it be done through a HELOC or a refinance? Here’s a clear breakdown to help make sense of the differences. What is a HELOC? A HELOC

-

Celebrating 4 years in Business

🎉 𝑪𝒆𝒍𝒆𝒃𝒓𝒂𝒕𝒊𝒏𝒈 4 𝒀𝒆𝒂𝒓𝒔 𝒊𝒏 𝑩𝒖𝒔𝒊𝒏𝒆𝒔𝒔! 🎉 Today marks 4 incredible years since I took the leap into the world of mortgages — a world that was entirely new to me. For those who don’t know my story:I didn’t come from a financial background. I had no customer service experience. I started while raising two

-

Bank of Canada Holds Rates Steady as Tariff Clouds Linger

Bank of Canada Holds Rates Steady As Tariff Turmoil Continues As expected, the Bank of Canada held its benchmark interest rate unchanged at 2.75% at today’s meeting, the third consecutive rate hold since the Bank cut overnight rates seven times in the past year. The Governing Council noted that the unpredictability of the magnitude and

-

Credit Score Recipe (How credit score is formed)

How Is Your Credit Score Actually Formed? Let’s Break It Down Your credit score is more than just a number — it’s your financial reputation. Whether you’re planning to buy a home, refinance, or just want better rates, understanding how your score is calculated can help you make smarter choices. Here’s a quick breakdown of

-

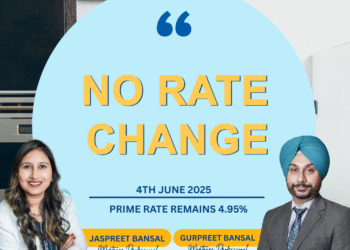

Bank of Canada Holds Steady – No Change in Prime Rate

📢 Bank of Canada Holds Steady – No Change in Prime Rate The Bank of Canada announced today that there will be no change to the policy interest rate. As a result, the prime lending rate remains steady at 4.95%. What does this mean for you? ✅ Variable-Rate Mortgages:No change in your payments for variable-rate

-

GST Rebate on New Homes Up to $1.5 Million

GST Rebate on New Homes Up to $1.5 Million If you’re a first-time home buyer in Canada, May 27, 2025 could become a milestone date for you. The federal government has announced a major housing affordability initiative that could save you up to $50,000 on your first home! This new GST relief program is aimed

-

Understanding Default Mortgage Insurance in Canada

Understanding Default Mortgage Insurance in Canada: What Every Homebuyer Should Know Buying a home is one of the biggest financial steps you’ll ever take—and for many Canadians, getting approved for a mortgage with less than a 20% down payment means you’ll also need default mortgage insurance. But what exactly is it, why do you need

-

Understanding the Different Types of Insurance When Buying a Home

Understanding the Different Types of Insurance When Buying a Home Buying a home is one of the biggest investments you’ll make in your lifetime — and protecting that investment is just as important as finding the perfect property. There are several types of insurance you may need (or want) when purchasing a home in Canada.

-

Lenders Potluck Organized by Mainstream Mortgages

Lenders’ Potluck Organized by Mainstream Mortgages Behind Every Successful Mortgage Broker Is a Strong Lender Relationship — A Recap of Our 2nd Annual Lenders Potluck At DLC Mainstream Mortgages, we know that relationships fuel results — and our 2nd Annual Lenders Networking & Potluck Event was a beautiful reminder of just that. We welcomed lenders

-

Rent-to-Own Agreements: What Tenants Need to Know Before Signing

Rent-to-Own Agreements: What Tenants Need to Know Before Signing Are you thinking about signing a Rent-to-Own agreement because you’re not eligible for a mortgage today? 🏡 Rent-to-Own can seem like a great option for those who are not quite ready to buy a home — maybe your credit score isn’t where it needs to be,

-

Homeownership Seminar #4: Another Successful Event!

Homeownership Seminar #4: Another Successful Event! This past weekend, we wrapped up our 4th Homeownership Seminar, and it was an incredible success! 🏡✨ I’m so thankful to everyone who attended, shared their questions, and engaged with the valuable insights we covered. The goal of these seminars has always been to simplify the homeownership process and

-

Announcing 4th Edition of Homeownership Seminar!

Announcing 4th Edition of Homeownership Seminar! EXCITING NEWS! We’re thrilled to announce the 𝟒𝐭𝐡 𝐄𝐝𝐢𝐭𝐢𝐨𝐧 𝐨𝐟 𝐨𝐮𝐫 𝐇𝐨𝐦𝐞𝐨𝐰𝐧𝐞𝐫𝐬𝐡𝐢𝐩 𝐒𝐞𝐦𝐢𝐧𝐚𝐫, 𝐡𝐚𝐩𝐩𝐞𝐧𝐢𝐧𝐠 𝐨𝐧 𝐒𝐚𝐭𝐮𝐫𝐝𝐚𝐲, 𝐌𝐚𝐫𝐜𝐡 𝟏𝟓𝐭𝐡, 𝐟𝐫𝐨𝐦 𝟏𝟐 𝐭𝐨 𝟐 𝐏𝐌! GET AHEAD OF THE REAL ESTATE RUSH! Join our exclusive seminar to gain insider knowledge and make smart, confident decisions in today’s market. 𝐖𝐇𝐀𝐓 𝐘𝐎𝐔’𝐋𝐋 𝐋𝐄𝐀𝐑𝐍:

-

Gurpreet Bansal, has officially joined as a Licensed Mortgage Professional!

Gurpreet Bansal, has officially joined as a Licensed Mortgage Professional! I’m beyond excited to share that my husband, Gurpreet Bansal, has officially joined me in the mortgage industry as a 𝐋𝐢𝐜𝐞𝐧𝐬𝐞𝐝 𝐌𝐨𝐫𝐭𝐠𝐚𝐠𝐞 𝐏𝐫𝐨𝐟𝐞𝐬𝐬𝐢𝐨𝐧𝐚𝐥! 💼🎓 𝐹𝑟𝑜𝑚 𝑠𝑢𝑝𝑝𝑜𝑟𝑡𝑖𝑛𝑔 𝑚𝑒 𝑏𝑒ℎ𝑖𝑛𝑑 𝑡ℎ𝑒 𝑠𝑐𝑒𝑛𝑒𝑠 𝑡𝑜 𝑛𝑜𝑤 𝑤𝑜𝑟𝑘𝑖𝑛𝑔 𝑎𝑙𝑜𝑛𝑔𝑠𝑖𝑑𝑒 𝑚𝑒, 𝐺𝑢𝑟𝑝𝑟𝑒𝑒𝑡 𝑏𝑟𝑖𝑛𝑔𝑠 ℎ𝑖𝑠 𝑡𝑒𝑐ℎ𝑛𝑖𝑐𝑎𝑙 𝑒𝑥𝑝𝑒𝑟𝑡𝑖𝑠𝑒 💻, 𝑑𝑒𝑑𝑖𝑐𝑎𝑡𝑖𝑜𝑛 💪, 𝑎𝑛𝑑 𝑝𝑎𝑠𝑠𝑖𝑜𝑛

-

Good News For First Time Homebuyers

Starting today, December 15th, two exciting changes are here to make homeownership more accessible for those with less than a 20% down payment. 30 Year Amortization for Resale Properties and Purchase Price Limit Increased to 1.5M.

-

New actions to build secondary suites and unlock vacant lands to build more homes

Govt. unveiled a series of initiatives to encourage the construction of secondary suites and unlock underused land for housing. These changes present incredible opportunities for homeowners and our communities.

-

Registered Retirement Savings Plan (RRSP) Withdrawl Limit Increase to $60,000

The government announced an increase in the maximum amount that first-time homebuyers can withdraw from their Registered Retirement Savings Plan (RRSP) to buy a home. The previous limit was $35,000, and it has been raised to $60,000, effective for withdrawals made after March 19, 2019.